When choosing a Forex broker, traders must ensure that the company is regulated. It must also provide convenient banking options for deposits and withdrawals. In addition, it must offer a wide selection of financial instruments and low spreads.

It is also important to know whether the broker has a dealing desk or not. This could impact your trading strategy, especially if you use hedging strategies.

Availability of Demo Accounts

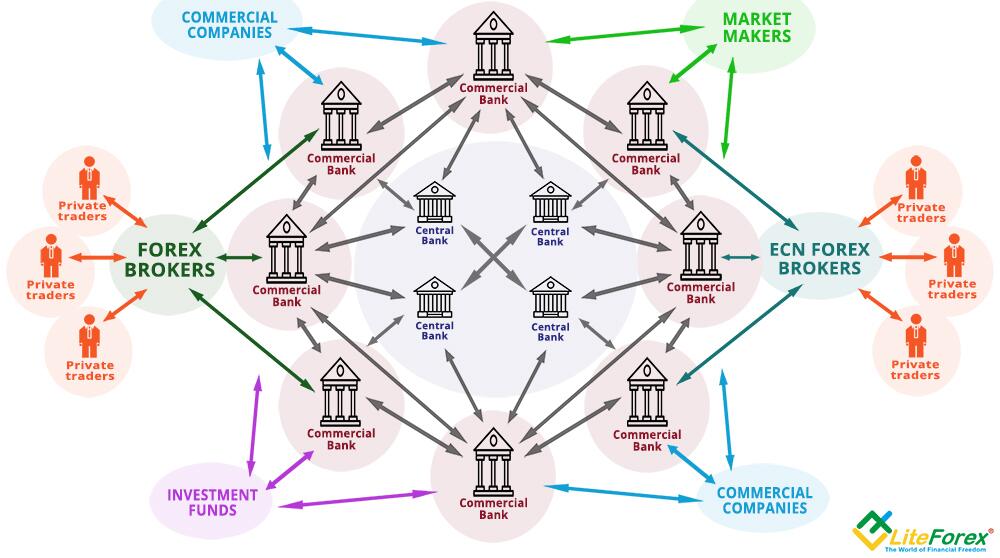

Forex trading is the act of buying and selling currency pairs on the foreign exchange market. This is an international marketplace for the trading of currencies and is one of the most liquid markets in the world. It is important to understand the basics of how the forex market works before you start trading. You can learn more by reading web articles and books on the topic. This will help you get a full understanding of how the market functions and the players that are involved.

You will need a forex broker to access the foreign exchange market and trade currency pairs. These brokers can be found online and offer a variety of different services. Some offer demo accounts, so you can practice your strategies without risking any money. In addition, they can also provide a range of trading platforms and tools. This way, you can find a broker that is right for your needs.

When looking for a forex broker, be sure to choose one that is licensed and regulated by the Commodity Futures Trading Commission (CFTC). This will ensure that your brokerage company is following strict payment security procedures. These include verifying customer identity, monitoring suspicious activity, and implementing KYC/AML policies. Failure to follow these regulations could lead to a loss of client funds and reputational damage for your brand.

Another thing to consider is the type of trading platform that your forex broker offers. Some brokers offer a proprietary trading platform, while others use a third-party software provider. The platform you choose should be able to handle the volumes that your business is likely to experience. You should also make sure that the platform is compatible with your preferred trading software.

Forex is a unique market and requires different criteria for evaluation than stock brokers. For example, a forex broker should be able to provide customers with a mobile app and allow them to try out trading strategies on a demo account before they commit real money. TD Ameritrade, for instance, is a top forex broker that provides traders with a mobile trading app and the thinkorswim trading platform. It also has a virtual investment consultant called Ted that can answer questions about trading strategies, investments and more.

Trading Platforms

The trading platform that a broker offers can make or break a trader’s experience. While a buy-and-hold investor can get by with a slow or glitchy platform, active traders and short-term traders live or die by the quality of the trade execution and the ability to see market movements in real time. A top trading platform can offer a fast and intuitive way to place orders, track a watchlist of securities and receive alerts, provide streaming news and offer tools to analyze complex options trades.

Many brokerages offer their own trading platforms, but some offer a suite of third-party applications and tools that can be integrated into the platform itself or accessed as standalone services. These include technical or fundamental research, charting packages and live news feeds. Some trading platforms also allow you to use algorithms designed to automatically trade specific strategies based on your specifications.

Choosing the right trading platform can be a challenge, especially since most brokers offer multiple tiers of trading platforms that have different fees and features. For example, TD Ameritrade has two trading platforms: its classic web-based GlobalTrader platform can do the basics and its thinkorswim platform is more sophisticated, offering a wide range of charting tools, advanced news feeds and more.

Look for a platform that is registered with the SEC and FINRA and offers a safe haven in case you encounter financial problems. You should be able to search for a brokerage’s registration using search tools like the SEC’s Investment Adviser Public Disclosure and FINRA’s BrokerCheck. Also, ensure that the brokerage is insured by the Securities Investor Protection Corporation (SIPC), which protects investors up to $500,000 in the event of a financial crisis. SIPC is a nonprofit organization that is similar to the FDIC, but it covers securities and cash instead of bank accounts. It also protects against losses due to fraud and unauthorized activity.

Trading Conditions

Forex brokers are specialized companies that provide traders with access to the market, execute trades, offer leverage, education and customer support. Choosing the right broker is an important decision that can have a significant impact on your trading success. There are a few things to consider before making your final choice, including regulation, trading platform, spreads and commissions, and customer service.

Brokers make money by charging a fee for each trade they execute on a trader’s behalf. This fee is usually deducted from a trader’s margin or added to the spread. The amount of the fee varies between brokers. Some brokers may also charge additional fees such as swaps or rollover fees. It is important to read the broker’s terms and conditions carefully to understand the exact charges that will apply to your trades.

Another way that brokers make money is by offering interest on the funds that their customers don’t use. For example, Schwab pays traders.12% on their cash balances that aren’t being used in their trading accounts. However, this is a very small portion of the overall revenue that brokers earn.

The most common method of earning money is through commissions. This is because the more money a trader makes, the more money the broker earns. However, there are many other ways that brokers can make money from the forex market. One of the most common is by providing educational material to their clients. This can be done through a range of channels such as videos, webinars and articles. Another option is to provide a virtual investment consultant, like the one offered by TD Ameritrade, which can help traders with their trading strategy and technical questions.

Regulatory bodies serve an important function in the forex industry. They set strict guidelines and standards that brokers must follow to protect traders. They also investigate and pursue complaints against brokers. It is important for traders to choose a regulated broker with a good track record of protecting their investments. Traders should also look for brokers that offer competitive spreads and low commissions.

Customer Support

When it comes to customer support, it is important that a forex broker have a team that is available around the clock to answer any questions you might have. Having an experienced and friendly customer service team can make all the difference when you are trying to trade. It is also important that the broker you choose has multiple communication channels, so you can contact them in a way that is most convenient for you.

Moreover, a good broker should have multiple languages so that they can cater to clients from all over the world. This can help them build trust with their customers and develop long-lasting relationships. By providing excellent customer service, a forex broker can ensure that their clients are satisfied and happy with their services.

In addition, a good broker should be licensed and regulated by the relevant authorities. This is important because it ensures that your money is safe and that the broker follows all local laws. This can protect you from scams and other pitfalls that can be associated with trading forex.

Another thing to consider is the size of a forex broker’s client base. A larger client base usually means that the broker is more stable and has a higher chance of staying solvent in times of economic uncertainty. This is especially true if the broker has diverse market participation across various geographies and asset classes.

When choosing a forex broker, it is also important to consider their level of transparency. A reputable broker should provide clear and concise information about their fees, spreads, and commissions. This will allow you to compare brokers and make an informed decision based on your trading needs.

Lastly, a good forex broker should have an extensive range of educational materials and tools to help traders understand the markets. This will enable them to make more informed trading decisions and improve their chances of success. In addition, a good forex broker will offer quality market access and trading platforms. This includes low-latency streaming data and fast order execution. This will help traders avoid expensive mistakes and achieve their trading goals more quickly and efficiently.